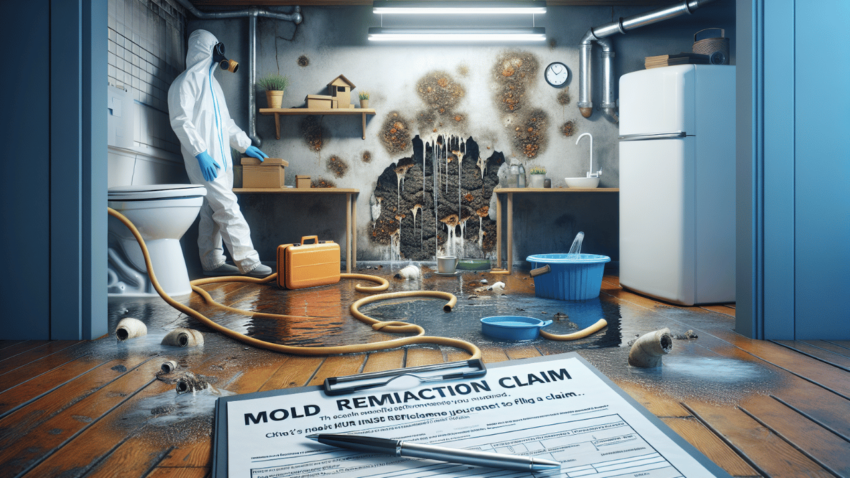

When the property gets affected by mold, you must act quickly as it spreads throughout the property, affecting the structural integrity. There might not be any superficial evidence, but mold can lead to multiple problems that can go beyond repair. You must seek insurance claims to ease your burden and provide proper remediation in this situation. However, you need to understand the different coverage options available in New York. So, let’s learn more about mold remediation insurance claims and what type of coverage would best suit your condition.

What does mold insurance cover?

Usually, mold is an after-effect of water damage, and having mold-damaged insurance can support you through financial loss and stress. Usually, policies cover water damage claims for unforeseen reasons, such as storms, sudden pipe bursts, or malfunctioning appliances. But, based on the type of insurance policy you have chosen, mold remediation can only be successful if the mold damage is accidental. However, if it occurred due to negligence, your claim will be denied.

You need to address water damage within 24 hours. Otherwise, it can lead to mold growth, and, in such cases, the remediation for mold damage won’t be covered by the insurance policies. If you detect an indication of mold growth in between water damage repair, you should immediately file for a damage insurance claim. An adjuster will be sent to your location to assess the condition, review your insurance claim mold water damage, and determine the coverage amount.

What are the different insurance policies that cover mold remediation?

There are separate mold remediation policies based on the property type, such as:

- Insurance policy

- Homeowner insurance

- Rentals Insurance

- Commercial property insurance

Always review the policy to address the mold remediation insurance claim and be transparent in your communication with the insurance agents or adjusters.

What are the steps for filing a mold damage claim?

You need to act soon enough and file a mold damage claim. These are the steps that you need to take:

- Documentation of the damage – You need to take photographs and videos of the effective areas to have proper documentation of the extent of damage. Wait for the insurance adjusted to arrive, and do not remove any damaged material

- Begin the claim process – You must contact the insurance company and report the damage. Provide exact details of the date of damage, the cause of the mold, and the extent of the damage.

- File a claim – Provide all the documentation and always be specific about the mold’s location and the damage’s extent. It would help if you kept a follow-up to ensure the claim is being processed.

Prepare all the answers that the insurance adjuster will ask for and also provide documentation of the damage. You need to keep a proper call log and record every detail of your communication with the insurance adjuster. If required, you can ask does renters insurance cover leaks?

Summing it up

The insurance adjuster would determine the cause of the mold and review the policy and the terms covered in the claim. Based on the assessment, you would get a notification about coverage, which can include mold removal, repair, or other related expenses. However, you must also be prepared about the coverage limitation and exclusion so you do not make any mistakes during the reimbursement process.